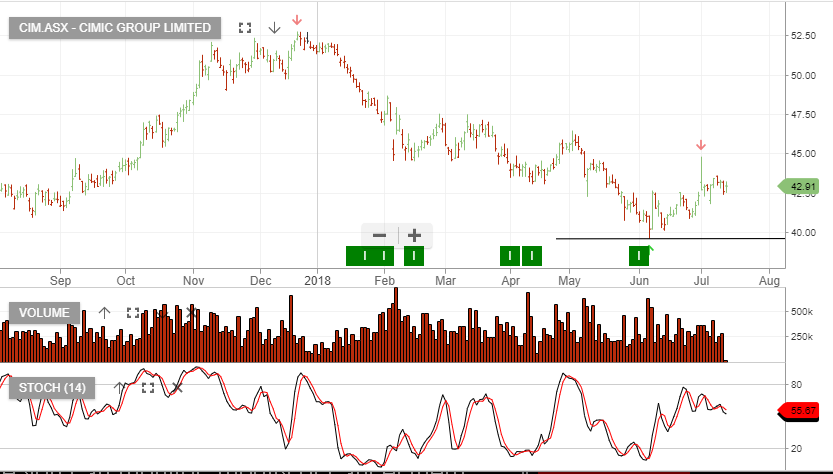

Buy CIMIC Group

Our Algo Engine generated a buy signal recently in CIMIC and we’re encouraged by the buying support which developed around the $40.50 level.

We continue to have a favorable outlook on the fundamental earnings backdrop for CIMIC and we expect next Thursday’s earnings announcement to further support the share price.

CIMIC goes ex-div $0.60 on the 12th September.

AGL

AGL